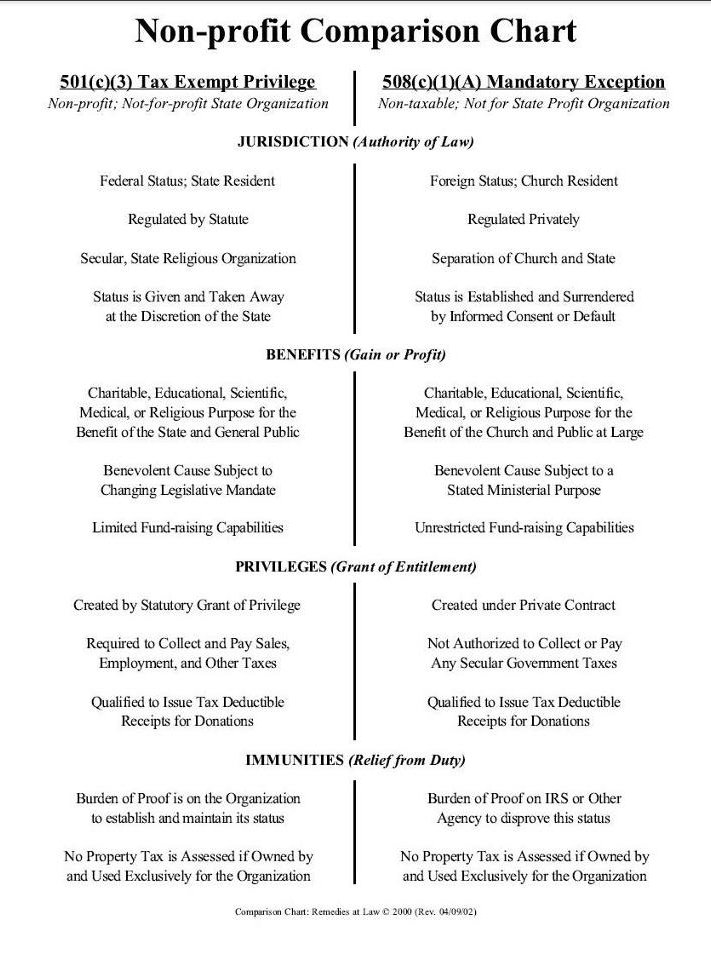

501(c)(3) vs 508(c)(1)(A)

Related Articles

Double Taxation with Corporation (C-Corp) vs LLC

Double taxation for a corporation is only valid if one does not redeem in lawful money. The benefit of having a corporation vs an LLC is the corporation DOES NOT pass through any liability; whereas, an LLC will pass through liability, thus it is ...

What Is A 508(c)(1)(A)

Also known as a Faith Based Organization (FBO) is a corporation whose primary purpose or activities are religious or religiously motivated. Even better, anyone can set one up! Judge Brattin, Eastern District of California, in Universal Life Church, ...

508c1a vs Trust - Which Is Better

A 508(c)1(a) / FBO (faith based organization) is for religious organizations. A trust is universally applicable for almost any situation or entity. Both offer similar protections. To further clarify a church can be a trust and a church can be placed ...

Going To Arbitration vs Court (Why To Control The Contract)

A Terms of Service which is “1-click away” on every page, even if a digital agreement was not signed, is still a contractual agreement by its sale from provider and purchase the user. That is why even when WayFair was caught illegally selling bed bug ...

Which Is Best: One C-Corp (Corporation) OR Multiple C-Corps (Corporations)

Most owners have multiple C-Corps if they have multiple businesses. The more that is separated, the more protection that is offered should one corporation be subject to a lawsuit.